Friday, April 29, 2011

Foreign Exchange Spreads

What is Spread in Forex Trading?

Spread in Forex Trading

In the forex market, spreads are the difference between the offer prices and the bidding prices that are quoted in pips. For instance, the quote of GBP/USD is 1.8281/84 which means that the bidding price of GBP is 1.8281 US dollar while the offer price is 1.8284 US dollar. In this particular case, the spread is 3 pips.

Role of Spread in Forex Trading

Spread is an important parameter that helps brokers to make profit in forex trading. Wider spreads indicate a high offer price and a low bidding price. This simply means that you have to pay more when you buy and make fewer amounts when you sell out, this property makes the realization and estimation of profit difficult for forex traders.

Spreads & Trading Skills

The return which you get on your trading skills is greatly affected by the spreads. Being a trader, your ultimate goal is to make profit by buying low and selling high. Traders usually take a half-pip lower spread as granted, but in reality it can make an effective trading strategy into an ineffective strategy.

Spreads & Execution

You can achieve stability and success with spreads only if you work with appropriate execution. The quality of execution identifies whether you are going to get tight spreads or not. You must be aware of the denied trades, slippage, delayed execution and stop hunting which nullifies the effects of tight spread forex trade.

You must always take forex spread into consideration with the depth of the book. In most cases, forex brokers provide tight spreads only for capped trading volumes which are totally inappropriate for the traditional forex trading strategies.

What Forex Brokers Claim?

Tight Spreads

At present, almost all forex brokers claim that they are having the tightest spreads in the forex industry. However, spread terms and policies vary remarkably from one forex broker to another, besides the transactions that are not clear. Some brokers offer non-variable spreads that remain unchanged regardless of the quality of the liquidity of forex market. However, non-variable spreads are usually higher than that of the variable spreads.

Some other brokers provide variable spreads in accordance with the liquidity of market. For such brokers, spreads become tighter when the market liquidity is at good level, however, it widens when the market liquidity falls. There are various brokers who provide different spreads for different forex traders.

Forex traders who are having larger forex accounts or others, who carry out big trades, may get tighter spreads than other traders. Therefore, it is a wise idea to seek for a broker who is offering you the tightest variable spreads without any discrimination.

An Introduction to Forex Trading

One might think forex trading is a piece of cake until they enter in it seriously. Beginner forex traders must work hard to achieve real success in forex market as a beginner. Beginners must follow effective strategies; they must acquire effective money management skills and gain complete knowledge about forex trading.

Beginners Forex Lessons

If you are starting your forex trading beginners for very first time then you should take help from beginner forex lessons. This is because there is a huge traffic of forex beginner traders because of the incorporation of convenient and welcoming ways to join forex trading. Forex trading market is growing rapidly and its annual turnover is 1.9 million USD. Beginners should not take it easy. Beginner forex lessons will help forex traders to understand the buying and selling processes in forex market. In forex market, currency exchange trading occurs in pairs and at the same time buying and selling occurs.

Starters Forex

If you are starting forex trading with a starter forex then you must know about the rules of forex trading business. Particularly, you should know the basics of the buying and selling different currencies. According to recent surveys, government or companies that buy or sell their services and products daily in other countries constitute over 5% of the total profit generated in forex market. On the other hand, the remaining 95% profit is contributed by the speculation methods.

Dominant Currency Pairs

Beginner forex is a great helping tool for amateur traders. It provides them information about the perfect currency pairs that are dominating the forex trading market.

The actual dominating currency pairs in forex market are listed below.

- USD-CAD

- EUR-USD

- NZD New Zealand Dollar-USD

- USD-CHF Swiss Franc

- AUD Australian Dollar-USD

- USD-JPY

- GBP-USD

Forex Quote

Beginner forex will help you to read the forex quote. Basically, forex quote comprises of two numbers. These numbers are bid and offer. The best way to understand forex quote is to use the currency pair. For instance, consider the currency pair AUD/USD. The cost offered by the Australian dollar will act as the bidding price and it will be used by the traders as a price to buy the Australian dollar against the USD.

On the contrary, the price that is offered by the US dollar will act as the offer price and it will be used by the traders to sell the Australian dollar against the other i.e. USD. At 1 point, the base price value is taken in forex trading.

What is expected from Beginner Traders?

- Beginner forex traders must acquire right approach while working in forex trading. This is a beginner forex is all about; it helps beginners to understand the two approaches of forex trading. These two approaches include two different analysis methods. Beginner forex traders should either work with fundamental or technical analysis.

- Beginner trader should also make contact with a genuine forex pips to get effective and correct guidance.

- Beginner traders should also acquire correct risk and management skills.

Forex Pivot Point Calculators

Forex Pivot Point

Popularity of Pivot Points in Forex Market

Forex Pivot Calculator

Resistance 2 = Pivot + (R1 – S1)

Resistance 1 = 2 ´ Pivot – Low

Pivot Point = (High + Close + Low )/3

Support 1 = 2 ´ Pivot – High

Support 2 = Pivot – (R1 – S1)

Support 3 = Low – 2 ´ (High – Pivot)

Low Point: 1.2213

Close Point: 1.2249

Resistance 2 = 1.2337

Resistance 1 = 1.2293

Pivot Point = 1.2253

Support 1 = 1.2209

Support 2 = 1.2169

Support 3 = 1.2125

What does it indicate?

Icelandic Kronur: Lessons from a Failed Carry Trade

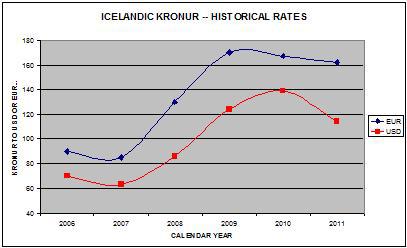

At its peak, nominal GDP was a relatively modest $20 Billion, sandwiched between Nepal and Turkmenistan in the global GDP rankings. Its population is only 300,000, its current account has been mired in persistent deficit, and its Central Bank boasts a mere $8 Billion in foreign exchange reserves. That being the case, why did investors flock to Iceland and not Turkmenistan?

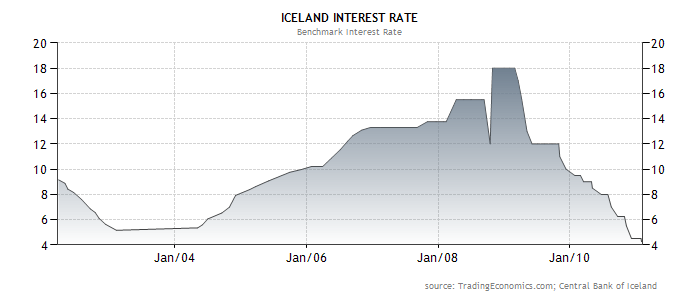

The short answer to that question is interest rates. As I said, Iceland’s benchmark interest rate exceeded 18% at its peak. There are plenty of countries that offered similarly high interest rates, but Iceland was somehow perceived as being more stable. While it didn’t apply to join the European Union (its application is still pending) until last year, Iceland has always benefited from its association with Europe in general, and Scandinavia in particular. Thanks to per capita GDP of $38,000 per person, its reputation as a stable, advanced economy was not unwarranted.

On the other hand, Iceland has always struggled with high inflation, which means its interest rates were never very high in real terms. In addition, the deregulation of its financial sector opened the door for its banks to take huge risks with deposits. Basically, depositors – many from outside the country – parked their savings in Icelandic banks, which turned around and invested the money in high-yield / high-risk ventures. When the credit crisis struck, its banks were quickly wiped out, and the government chose not to follow in the footsteps of other governments and bail them out.

Moreover, it doesn’t look like Iceland will regain its luster any time soon. Its economy has shrunk by 40% over the last two years, and one prominent economist has estimated that it will take 7-10 years for it to fully recover. Unemployment and inflation remain high even though interest rates have been cut to 4.25% – a record low. The Kronur has lost 50% of its value against the Dollar and the Euro, the stock market has been decimated, and the recent decision to not remunerate Dutch and British insurance companies that lost money in Iceland’s crash will only serve to further spook foreign investors. In short, while the Kronur will probably recover some of its value over the next few years (aided by the possibility of joining the Euro), it probably won’t find itself on the radar screens of carry traders anytime soon.

Now that the carry trade is making a comeback, it’s probably a good time to take a step back and re-assess the risks of such a strategy. Even if Iceland proves to be an extreme case – since most countries won’t let their banks fail – traders must still acknowledge the possibility of massive currency depreciation. In other words, even if the deposits themselves are guaranteed, there is an ever-present risk that converting that deposit back into one’s home currency will result in losses. That’s especially true for a currency that is as illiquid as the Kronur (so illiquid that it took me a while to even find a reliable quote!), and is susceptible to liquidity crunches and short squeezes.

Now that the carry trade is making a comeback, it’s probably a good time to take a step back and re-assess the risks of such a strategy. Even if Iceland proves to be an extreme case – since most countries won’t let their banks fail – traders must still acknowledge the possibility of massive currency depreciation. In other words, even if the deposits themselves are guaranteed, there is an ever-present risk that converting that deposit back into one’s home currency will result in losses. That’s especially true for a currency that is as illiquid as the Kronur (so illiquid that it took me a while to even find a reliable quote!), and is susceptible to liquidity crunches and short squeezes.Wednesday, April 27, 2011

Forex Ambush

The actual signals from Forex Ambush Software translate into “pips” and, since the signals are occurring at the precise minute that Forex Ambush 2.0 trades, you must be at your pc to access these signals and act upon them – should you opt for to do so. If your mobile phone is able to support the Forex software program, you can obtain the Forex Ambush 2.0 signals on your cell phone anywhere within the world and act on the signals received.

When trading in Foreign Exchange markets (Forex), the currency will be the “pip”. Forex Ambush 2.0 supports a trailing pip of 5, but some Forex software won’t support a trailing pip of below 15. Forex Ambush 2.0 have, nevertheless, thought of this and factored it in, with “expert advisor” software program which might be installed separately. This software program was developed for MetaTrader employing a 5 pip trailing quit.

Forex Ambush 2.0 function with a 5 pip trailing profit along with a 20 pip take profit. Stop loss just isn’t utilized with Forex Ambush 2.0. Fundamentally, without having going into too much confusing detail, if the signal falls between five pips and 20 pips, Forex Ambush 2.0 advises you to trade. If it falls outside of that, Forex Ambush 2.0 advises you not to trade. Basically, the automated trailing stop as well as the take profit will close the trade for you. Forex Ambush 2.0 advises you to by no means close a trade manually – leave your Forex software program running and your pc on and Forex Ambush 2.0 Software is developed to do the rest.

Sunday, April 24, 2011

Managed Account Forex Trading Software – Automated Forex Trading Software- Web-Based Forex Trading Software- Computer-Based Forex Trading Software

Foreign exchange or forex is a booming market and most of us are tempted to try our hand in this money game. Day trading refers to buying and selling of stocks most commonly in the foreign exchange market. As it deals with funds, a trader is required to be well funded, and the success depends on several factors, like the choice of software, choice of forex trading systems, understanding of the market, stock brokers, etc. So what is a forex trading software?

Well, these are trading software that help the trader in analysis and trade execution. It is difficult to name the best forex trading software because each forex broker has software with different features. Selecting a software is always about personal preference and your technical skills and trading style.

The best part about currency trading is you opportunity to make money even if the stock market is low, as there is always a variance in different currency rate.

Types of Forex Trading Software

There are four types of forex trading software and selecting one depends on your need and suitability. Before you zero in on a name, it is first important to understand what type is the best forex trading software for you. Here are the four types of trading software with the names of best currency trading software for each types.

Web-Based Forex Trading Software

This type of currency trading is done using a computer with internet connection from any location. Here the trader needs to go online using a user name and password. The main advantage of this type of software is that the user can access it from anywhere in the world and there is no need to download a software. This is a secure trading software, as your information is in an encrypted form and the software provider always has a backup of your data, in case of data loss. Easy-forex and eToro are some of the best best forex trading software if you wish to carry out online trading.

Computer-Based Forex Trading Software

This type of currency trading can be done using your local desktop or laptop computer. Though this is convenient for most people, there are a number of risks attached to this type of currency trading, like data loss and computer virus. Make sure you have a good internet connection for fast transfer of data, else it might have a negative impact on your trading. So whenever you use this type of software, always create a backup file, keep the data password protected and make sure your computer has a strong and genuine antivirus software. MetaTrader and VT Trader are good stand-alone forex trading software.

Automated Forex Trading Software

The introduction of automated forex trading software has made trading easier, faster and less taxing. You do not waste your time understanding and is quite inexpensive compared to other types of software. The convenience of use and implementation, high accuracy, good return for investment and cost should be the important criteria to look for, while deciding which is the best forex trading software for you. These are also known as day trading robots as the trading is done by the software itself with minimum or no help from your end, so it is mostly used by beginners to learn the ropes of the trade. Forex Tracer, Forex Autopilot and Forex Raptor are some highly recommended and best automated forex trading software available in the market.

Managed Account Forex Trading Software

This is a software for those people who are interested in investing money in forex trading, but do not have the time or interest in trading themselves. Here a trading expert manages your account on your behalf with the help of this software. This is also for those who have tried their hand, but do not have the required knowledge and skills for trading. Some established names of this type of software are CTS Forex, ZuluTrade and dbFX.

Tips for Choosing a Forex Trading Software

Since you are dealing with money, and in a highly competitive market, there are very high chances of loss if you are not cautious enough. Trading means one man’s loss is another man’s gain. So you don’t want to be at the losing end, and want good returns for your investment. So, these are few tips to help you choose the best forex trading software available online:

Tip 1: Never buy a software before trying. Most stock brokers offer a trial version of their software, so try out a few software before you buy one.

Tip 2: Once you have tried a few software, select one that is fast and saves time.

Tip 3: Look for a user friendly software. You do not want to waste most of your time in understanding the features of the software.

Tip 4: Read best forex trading software reviews and comments online about the software of your interest.

Tip 5: Always check if the software is compatible with your computer system. Otherwise, see if you have the flexibility to upgrade the system.

Tip 6: Check for technical support of the trading software. A good software should also have a good technical support staff, in case of emergency or any glitches.

How often have you come across websites that vouch to make your 00 to 0000 in four hours? Well the numbers might differ, but the claims are still the same, to make you rich in just a few hours. Don’t get fooled by these claims. You are not the only trader in the market, there are thousands of people with the same goal and do not forget, there are Wall Street pros that you are competing against. Whatever you choose as the best forex trading software according to your requirements, the best lesson in currency trading is to keep realistic expectation. Don’t expect a miracle by giving in four hours of you time when there a people sitting there trading 24 hours a day. As trading software is an important part of the trading business, always read about the reputation of the software before you invest your money.

Article from articlesbase.com

Technical Indicators for Day Trading

Technical Indicators Helps in Making Forecasts

Moving Averages is the Frequently Used Indicator

Myth of Using Indicators

Other Issues Associated with Forex Day Trading Technical Indicators

Indicators were Developed Long Time Back

People who liked this Post also read

- Another Free Forex Analysis Software Tool

Instead of spending all the time, knowledge or inclination on several tables and huge information, now Forex analysis software can be used. Use of such software is easy and time saving.... - Euro Dollar Present & Future

The recession and financial crisis of 2008 left its footprints stamped on even the best of economies. The euro dollar suffered in the shape of its countries getting hampered by traumatic affects one by one, while the US dollar suffered the sting of it and... - What a Beginner Should Do In Forex Trading?

Forex market is a highly volatile market that is complicated for beginner forex traders. Beginners can attain stable success in this field by working with useful strategies and skills. They have to be consistent and work hard to achieve firm position in f... - Best Timing For Forex Trading

The influence of forex markets in the world is increasing on the daily basis. Forex market offers you to trade 24 hours a day and around a week. The key to increase your profit level is to select the best time for trading.... - What Are the Best Times to Trade the US Dollar?

The US is the world's second biggest forex trading center. The best time to trade the USD is when the US session is in progress. You have to take care of certain things while trading in the US session whether you are working on long or short term basis.... -

Asian sexy girl, Thai hot model and actress, Amika Klinpratoom’s pretty style

Thai sexy model, actress, Amika Klinpratoom’ beautiful style

Thai sexy model, actress, Amika Klinpratoom’ beautiful style Asian sexy model, Thai sexy girl, Amika Klinpratoom

Asian sexy model, Thai sexy girl, Amika Klinpratoom Thai sexy model, Hot Thai actress, Popular Thai celebrity, Amika Klinpratoom

Thai sexy model, Hot Thai actress, Popular Thai celebrity, Amika Klinpratoom Asian sexy model, Thai sexy girl, Thai hot model girl and actress, Amika Klinpratoom’ hot fashion.

Asian sexy model, Thai sexy girl, Thai hot model girl and actress, Amika Klinpratoom’ hot fashion. Saturday, April 23, 2011

Hot Gellery

Technical Analysis for Forex Trading

Technical analysis is the prediction method that is used in forex trading to forecast price action in forex market. This analysis works only on the data generated by the market. Almost every forex trader takes help from some type of technical analysis method to predict the forex market trend.Price Charts

Price charts are on of these analysis methods. By the help of price charts, traders can find out the perfect entry and exit points for any trading process. These charts provide a visual representation of the previous price movements. This feature makes it easier for traders to find out the upcoming price changes, as just by reviewing these charts traders can determines whether they are selling at a cyclical top or purchasing at a fair price.

Perfect Technical Analysis

A perfect technical analysis method also takes the fundamental pointers into consideration and it works with these pointers by joining them with the data tables and charts. The assumption that is used in technical analysis is that it incorporates all the basic fundamentals into the actual market data.

Basic Principles of Technical Analysis

There are certain principles that are working behind all the technical analysis methods. Basically, there are three main principles and these principles are actually the market actions that are taken in accordance with the latest events, historical forex trends, and price action trends.

Role of Mathematical Representations

Basically, technical analysis methods are highly dependent on the mathematical calculations that are done for the forex market behaviors and patterns. These representations are mainly the volume charts, price charts and a huge list of various particular analysis methods.

Role of Market Data

The data that is generated by the market is used to identify the sustainability and intensity of a specific trend. Therefore, technical analysis is the method that enables you to create an efficient trading plan.

Role of Chart Patterns

A variety of chart patterns is included in few of the basic pie charts that determine the price movements. The commonest charts include the bar charts.

Each bar chart describes one time period that could consist of any duration i.e. from one minute to several years.

Candlestick Patterns

Forex charting techniques or candlestick patterns are used to predict the trends of forex market. Candlesticks patterns provide eye candy visual details within the bar graphs and other chart patterns with its colored bodies.

Usually the figure and point patterns are similar to that of the bar chart; however, the Os and Xs are utilized for the changes in market in the price actions.

Technical Pointers – These pointers such as market volatility, strength, cycle, trend, resistance or support, momentum pointers are also the important and inevitable tools in technical analysis. Trends determine the constancy of price actions in a single direction over a particular period of time. Trends move in three distinct directions i.e. up, down and sideways.

Market Intensity – It is the strength of forex market opinion in accordance with the price by the market positions examination carried out by different participants of the market. They are basically consisted of the open interest or volume.

Market Volatility – It is the magnitude of forex market or the size of the every day price fluctuations independent of the direction of price. Changes in the market volatility lead to the price changes.

Cycle – It basically points out the repetition pattern of the movement of market in accordance with the recurrent events like yearly budget, elections, or seasons. Cycle pointers actually identify the timings of specific patterns of market.

Resistance or Support – It describes the levels of price within which the markets repeatedly changes i.e. rise or drop and reverse.

Momentum – It is the speed of price movements within a given period of time. The momentum pointers identify the weakness or strength of any particular trend. Usually, at the beginning of a trend momentum is at its highest point, while it reaches its lowest point at the turning points of the trend.

Effective Application of Technical Analysis

In order to utilize technical analysis in an effective manner, you have to understand the basic points of technical analysis. You should bear in mind that your primary tool is price. Apart from that, almost all systems use the technical methods to dig the data deeper. You should be aware of how and why all technical studies can be connected together to produce effective results.

People who liked this Post also read

■Automatic Forex Trading Systems

If you intend to do automatic forex trade then you have three distinct options to do so. These options include a trading robot, forex account managers and third-party providers. Before selecting any of these methods, you should understand these three meth...

■Overview of Forex Trading

If you want to make some real profit in forex trading market then you should acquire authentic information about this industry. Make a good trading plan and strictly follow it to attain stability in forex trading business....

■ Another Free Forex Analysis Software Tool

Instead of spending all the time, knowledge or inclination on several tables and huge information, now Forex analysis software can be used. Use of such software is easy and time saving....

■How to Trade In 2011?

For the forex traders, there are a lot of efficient trading techniques, which help in enhancing the profit. However, shortly term trading is more efficient than long term trading. Same way the early rising trader is more profitable than late rising. ...

■Euro Dollar Present & Future

The recession and financial crisis of 2008 left its footprints stamped on even the best of economies. The euro dollar suffered in the shape of its countries getting hampered by traumatic affects one by one, while the US dollar suffered the sting of it and...

Trading Forex Like a Pro

The Basics of Forex Trading

There are business centers like New York Stock Exchange, where you have to complete all your transactions within a given time. Forex trading is different from stock exchanges and other business centers, because forex trading is a 24 hours business. The forex market is open 24 hours a day and 6 days a week. The forex market is not centralized and extends to several times zones around the world. The traders do their business with the help of communication systems and other tools such as the internet.

What is the Importance of Currency Trade?

How to Become a Currency Trader

Internet Resources

People who liked this Post also read

- What Are the Best Times to Trade the US Dollar?

The US is the world's second biggest forex trading center. The best time to trade the USD is when the US session is in progress. You have to take care of certain things while trading in the US session whether you are working on long or short term basis.... - Online Currency Trading

In order to start online FOREX trading business, the learning is the basic step. There are brokers, data and demos available for those who want to start their career in this business. The online FOREX trading has its own benefits like its a 24 hour servic... - Benefits of Online Forex Trading

Since its inception in 1994, online Forex trading has not only become widely popular amongst the people across the world, but it has also replaced the conventional method of Forex trading to a larger extent. With the help of online Forex trading, even peo... - Mini Forex Accounts

Mini forex accounts are great tools for new forex traders to start forex trading business. There are no hard and fast rules about cash to open mini forex accounts. Due to this quality, even individuals having low cash can start forex trading with these ac... - A Brief History of Forex Trading

Forex trading is an ever-growing market. It is offering great benefits to its participants. Forex trading has passed through many changes and now it has attained the place of one of the most profitable businesses. It allows small investors to make real pr...

Friday, April 22, 2011

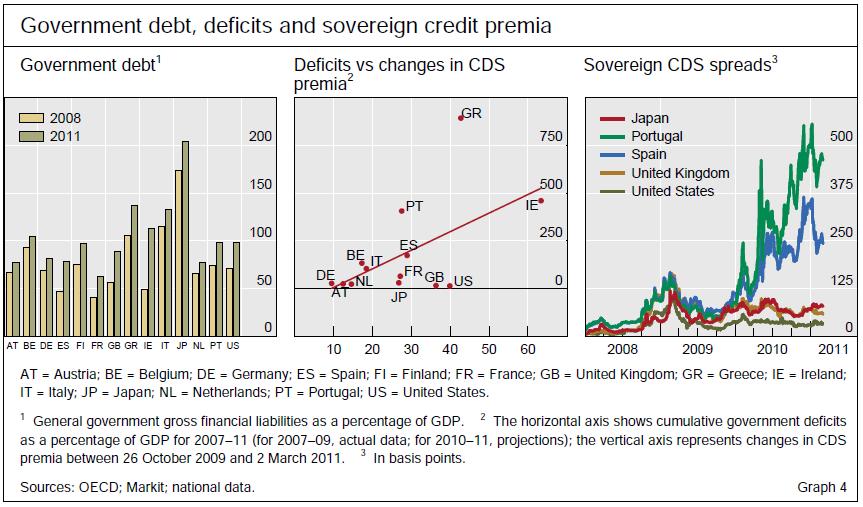

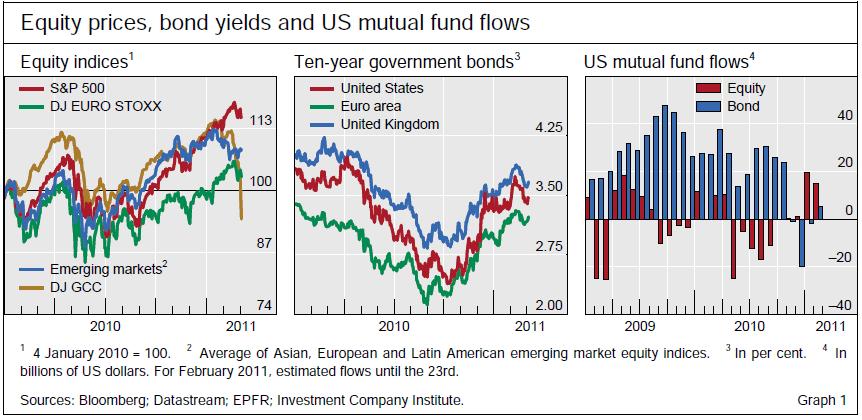

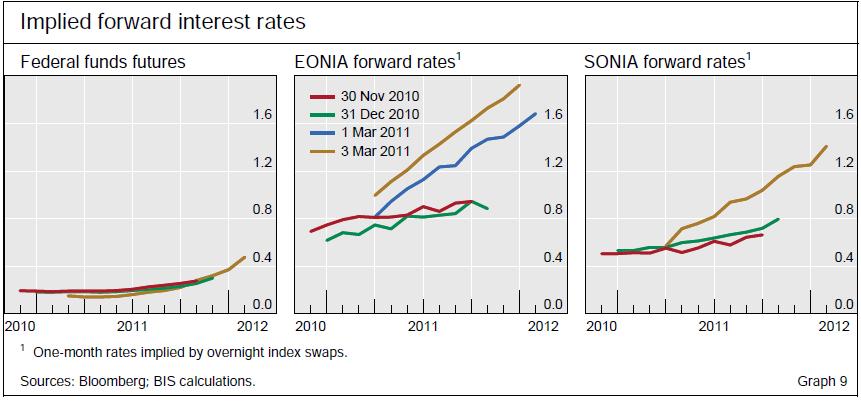

Where are Exchange Rates Headed? Look at the Data

Anyway, the stock market rally that began in 2010 has showed no signs of slowing down in 2011, with the US firmly leading the rest of the world. As is usually the case, this has corresponded with an outflow of cash from bond markets and a steady rise in long-term interest rates. However, emerging market equity and bond returns have started to flag, and as a result, the flow of capital into emerging markets has reversed after a record 2010. Without delving any deeper, the implication is clear: after 2+ years of weakness, developed world economies are now roaring back, while growth in emerging markets might be slowing.

The picture for emerging market economies is slightly less optimistic, however. If you accept the BIS’s use of China, India, and Brazil as representative of emerging markets as a whole, rising interest rates will help them avoid hyperinflation, but significant price inflation is still to be expected. I wonder then if the pickup in cross-border lending over this quarter won’t slow down due to expectations of diminishing real returns.

Thursday, April 21, 2011

The Hunt For The Greatest Forex Signals

Followers

Blog Archive

-

▼

2011

(166)

-

▼

April

(20)

- Foreign Exchange Spreads

- An Introduction to Forex Trading

- Forex Pivot Point Calculators

- Icelandic Kronur: Lessons from a Failed Carry Trade

- Forex Ambush

- Managed Account Forex Trading Software – Automated...

- Technical Indicators for Day Trading

- Asian sexy girl, Thai hot model and actress, Amika...

- Hot Gellery

- Trading Forex Like a Pro

- Where are Exchange Rates Headed? Look at the Data

- The Hunt For The Greatest Forex Signals

- นมใหญ่, Model Sexy Girl

- If You Are Fascinated In This Enterprise, Listed B...

- Forex Becomes A Mass Movement

- เก็บตก “สวยๆ งามๆ” งาน “Bangkok International Moto...

- Fed Mulls End to Easy Money

- Retail Forex: Lower Corporate Profits = Lower Spre...

- Forex Trading Software Strategies

- Interview with Mike Kulej of FXMadness: “Trading t...

-

▼

April

(20)